Must Trades be Equal in Value to be Moral?

by Sherwood R. Kaip, M.D.; Copyright

(915) 309-6340; skaip799@gmail.com

Association of American Physicians and Surgeons

The Moral Question

All economic activity consists of trades. Usually we trade cash for goods or services from others, or we trade our labor for cash, and then trade the cash for whatever we really want. But at each stage this is merely a trade. The question we are going to consider is the following: As a Judeo-Christian MORAL principle, should all trades result in equal value being received by both parties?

For your information I will state that the usual answer I have received to this question is either, "Yes," or something like, "Well equal value trades are a nice ideal that could be attained with socialism, but capitalism is more efficient at producing goods and services for more people so it's better for everybody to have capitalism, even if somebody does have to come up short in the trade."

What is Value?

To answer this question properly, we must first cover the subject of value rather quickly. The earliest theory was the objective theory of value, i.e., all goods and services were felt to have an inherent value. The innumerable rules and regulations under mercantilism where the king's ministers set prices, wages, how apprentices were to be treated, etc. were an attempt to see to it that the exchanges were at the proper or 'objective' value so that both parties would get equal value out of the transaction and neither would be cheated. In modern terms, this was a sort of planned economy. 'The problem with this objective theory was that no one could find an objective method by which to determine these values—they always seemed kind of arbitrary.

The next step was the 'labor theory of value' which states that the value of something is proportional to the amount of human labor used to produce it. Surprisingly, both Karl Marx and Adam Smith believed in the labor theory of value. The major difference was that Adam Smith would probably never have driven it into the ground as Marx did. Before Smith would have taken it that far he would probably have questioned his premises. The problem with the labor theory of value essentially is that mud pies are worth as much as apple pies if the same amount of effort (labor) was put into them.

This brings us to what must by now be obvious, the subjective theory of value. Amazingly, this principle was not written up until about 1870. It is also sometimes called the marginal utility theory of value (meaning you probably value the 5th apple you have eaten in the last hour somewhat less than the 1st one) but still this is a subjective theory of value. The subjective theory of value simply means that the value of something is what people will give in willing exchange. This can vary with different people of course, and it can also vary with the same person in different circumstances. The 1st versus the 5th apple is one example.

Another example is that you will pay a lot more for the ingredients of a hot dog when you are buying them at a ball game than you will when you are buying them at a supermarket. You could have bought the ingredients at the market, brought them to the game, and saved some money, but most people would rather not take the chance of busting the mustard jar in their car, etc., so they just go ahead and pay more for the hot dog at the ball game. Remember, no one forced them to buy that hot dog so the value to them at the time at least equaled what they paid for it otherwise they presumably would not have bought it.

People desire and will pay more for apple pies than mud pies, no matter how much or little labor goes into making the mud pies, so we say that apple pies are more valuable than mud pies. As a nonsmoker, a cigarette has almost no value for me no matter how much labor went into producing it. On the other hand, a smoker out of cigarettes would pay quite a bit if necessary to get the same cigarette even though the amount of labor is the same in both instances.

Simple Game Theory

Now that we understand that value is subjective, we are ready to discuss the concept of a Zero Sum Game. A Zero Sum Game occurs when some friends get together at someone's house to play poker. If I go away with $300 more than I came with, one or more people went away with $300 less. This is the meaning of a Zero Sum Game—the amount that left with the group was the same as the amount they brought in. A Negative Sum Game would occur if we had gone to Las Vegas and played poker and the house took 10% out of each pot. As far as our group is concerned, the amount that left with us was less than what we brought in.

It follows then that we can define a Positive Sum Game. A Positive Sum Game occurs when the total amount that the group leaves with is greater than the amount they came in with. It would be pretty hard to find someone to stake us to that kind of a poker game, but there is a situation in which this occurs, and that is in free market economics. We must understand firmly that when we speak of a free market we mean a market where there is no force and no fraud. All transactions are consummated only when BOTH parties agree to do so.

Equal and Unequal Trades

Suppose I came to work every day with 2 pints of milk and you came to work with 2 pints of milk and I said one day, "Let's trade." You would probably say, "Why bother?" But isn't this the most equal possible trade imaginable? If your milk is the same as my milk there can be no thought of one of us taking advantage of the other for the values of objects are certainly equal if they are the same thing. Or if I came to work with 2 peanut butter sandwiches and you came to work with 2 peanut butter sandwiches and I said, "Let's trade," and the sandwiches were identical, we could do it, and there certainly would be no disadvantage to either party other than the nuisance of doing it, but who would bother. Now we have the glimmer of an idea. PEOPLE DO NOT TRADE FOR EQUAL VALUE. That would be like trading a quarter for a quarter or a dime for a dime.

PEOPLE ONLY SEEK TO TRADE WHEN THEY EXPECT TO GAIN. Most people realize this and some even feel guilty about it. What most people do not seem to realize is that usually the other party to the trade did not just arrive in town on a load of pumpkins. HE TOO EXPECTS TO GAIN. Otherwise he won't trade with you! If a trade occurs (without force or fraud), it is because both of you have given up what you valued less to get what you valued more.

Choke and Slide

Now if I came to work every day with 2 peanut butter sandwiches and you came to work every day with 2 pints of milk, and you were tired of hearing me choking on my second peanut butter sandwich, and were upset by the fact that by 2 o'clock every day your stomach was growling, you might want to consider a trade—one of my sandwiches for one of your pints of milk. The question immediately comes to mind, if I accept this deal, who gained? Obviously we both did. I now not only won't be choking on the second sandwich but can get the 1st one down easier, and you will have something in your stomach at 2 o'clock instead of having to listen to it growl.

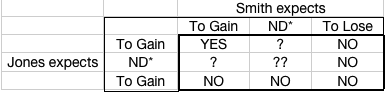

Why did I trade? Because at this time I valued a pint of milk more than a 2nd peanut butter sandwich. If I had valued my 2nd peanut butter sandwich more than the pint of milk, I would have refused to trade (unless I did it for reasons of charity). Why did you trade? Because at this time you valued a peanut butter sandwich more than a 2nd pint of milk. If you had preferred the 2nd pint of milk to a peanut butter sandwich, you would have declined to trade. Since a free trade can occur only if both parties agree, there won't be any trade unless both parties expect to gain from the deal. (Remember, no force or fraud). This can be shown in the "truth table" below which gives all the possibilities and states whether or not a trade will occur.

WHEN WILL A TRADE TAKE PLACE?

What is Wealth?

Material wealth is having the goods and human services you want when you want them. MONEY IS NOT WEALTH. If you were wealthy and traded all your current assets for money and then were told you could never ever trade the money for anything else, you would not feel wealthy and you would not be wealthy. Money is useful because it can be turned into wealth, i.e., it can be exchanged (or held to be exchanged later) for things which you really value. If given a Macintosh computer, I would be ecstatic. I would consider having this an increase in my wealth. Many-people would consider it only so much dead weight except that they might be able to trade it for a large screen projection TV set at which point they would consider that their wealth had increased. So if I now have more of the things I want or the means to obtain these (money or tradeables), then I am wealthier than before. If I receive something in an exchange that I value more than what I gave up (and I wouldn't agree to the trade unless I did), I have an increase in wealth.

Remembering that money is not wealth, since both parties gained more value than they gave up, the total wealth after a freely made transaction is greater than the total wealth before the transaction. Please note that the 'total wealth' we are talking about here is actually the total wealth of the community since these two traders are part of the community and neither they nor anyone else has lost anything! This is the definition of a Positive Sum Game, i.e., more value was taken out of the transaction than was brought into it. A little thought about this will cause you to realize that this increase in each individual's wealth and the total wealth is a characteristic of all freely entered, non fraudulent, non-coerced trades. If either party expected to come out worse, he would not agree to the trade.

The Value of Freedom

All free economic activity is carried out as part of the Positive Sum Game principle and therefore the person (or country) which is the richest (again barring fraud or force) is the person who has "produced" the most, at least by the valuation of the 'TRADEES' who traded economically with him. Notice that I did not say that it depends on what YOU think! I happen to think that a bartender is passing out poison but I would not deny him or the adult person for whom he is making the drink that privilege. In the opinion of the consumer of that alcohol the bartender has provided him something which he desired and it is the customer's and bartender's opinions which count in this transaction, not mine. So if you are better off on the economic scale and you didn't get there by force or fraud, go ahead and feel proud of it....you have no reason to feel guilty (unless of course you disapprove of the service you are providing). Someone was happy that you were around.

Ford, Good or Bad?

Let us look at the late Henry Ford, the billionaire founder of the Ford Motor Co. If both participants in a trade should as a moral principle receive equal value, then we are describing a Zero Sum Game. Since in a Zero Sum Game no matter how many trades you consummate your total value should be the same as when you started, any indication that someone has gained, such as Henry Ford becoming a billionaire, means almost by definition that practically all that wealth had to be ill-gotten—stolen, if you will. This is the reason that so many people think that wealth is an indication of stealth. They implicitly believe in the Zero Sum Game theory of economics. By this criterion, Henry Ford had to be one of the most evil men that ever lived.

The Fallacy of Equality

The basis of much of the intellectual support of socialism is the mistaken belief in the Zero Sum Game fallacy. It is thought that a fair exchange would cause everyone to be equal and therefore if everyone is not exactly equal in monetary possessions it is because those who have more have stolen. Thus any system of leveling, such as progressive tax rates and even impediments to business, is what seems fair. In fact many people consider establishing such measures a moral obligation, at least until the socialist millenium can be established (by legislative FORCE, of course). Thus, one author of a textbook used in a Texas University, because of this fallacy which he and many, many other people hold, can make statements which appeal such as:

"The boss hires us because he can make a profit from our labor, the landlord rents to us so that he can make an income from our rental; the manufacturer sells to us because he can make more wealth on his product than he puts into it; and the bank or loan company extends credit so that it can get back substantially more than it lends."

Now the fallacy becomes ridiculously obvious. Why else would any of these people engage in any of these occupations? What the author has failed to see, however, is that the worker works for the boss because at the present time he is not aware of a more desirable job and has chosen not to go into business for himself, the renter rents from the landlord because he chose not to buy his own home yet, he bought from the manufacturer because he preferred his product to some other or because he chose not to make it himself, and he borrowed money because at the moment he would rather have what it was that he purchased with the borrowed money rather than having to save the money and wait till next year to buy the item. And so in each case, he made a decision freely in which he decided he gained. Maybe you don't think the decision was wise, and that's your privilege, but you fortunately do not have the right to force him to act and decide on the basis of your preference. And I do not have the right to force you to act or decide on the basis of my preferences. That's what we mean by freedom.

The Positive Sum Game

On the other hand, when one comes to the realization that free-market economics is a Positive Sum Game in which both parties gain, and their gains added together represent an increase in the total 'wealth' of both parties and therefore the community, then one must realize that he who does the most for the most people, BY THE VALUATION OF THOSE OTHER PEOPLE, will have the most trades and gains to show for it. This is what the Positive Sum Game theory of economics, the correct version, means.

Therefore, although you probably wouldn't care to have had Henry Ford as your father, as far as his being an economic actor in the market place, Henry Ford became very wealthy by making millions of poor people rich owners of cars which, because of the way cars had been manufactured previously, they could not have afforded otherwise. On each sale, the buyer gained a little and Henry gained a little. If buyers hadn't felt they gained, they would have quit buying.

To put it another way, the reason that we in the United States, while having less than 6% of the world's population, have a very much larger percentage of the world's telephones and automobiles isn't that we have "stolen" these things from the poor countries but that we have produced them. (Or we have produced other things and traded for them.) We are richer because we have produced more effectively, thanks to the capital invested in our means of production which enables a worker to accomplish far more than he could totally isolated. I hope by now you have gotten rid of any guilt feelings you may have been harboring about belonging to one of the richer societies on earth.

Freedom vs. Force vs. Monopoly

Now keep in mind that this "Positive Sum Game" theory is being applied ONLY to freely-made and non fraudulent transactions. Obviously if you FORCE the other party to give you both of his pints of milk for one of your sandwiches or fraudulently dilute the milk 20:1 with water without the other person realizing it, we are talking about a different situation than most normal economic activity. If wealth is obtained by force or fraud (and it can be done, of course) then the "Positive Sum Game" principle does not apply and such wealth is indeed at the expense of others.

Force can be such obvious things as stealing or armed robbery but it can also be, and often is, profitability made possible by having a monopoly position protected by the government. Effective monopoly is only possible by use of force such as the Mafia seeing to it that it operates the only "protection" business in town, or the government specifying that only certain firms can enter a given business, or regulations being so numerous or onerous that by the time they can be complied with there would not be enough profit likely to make it worthwhile.

If there is freedom for others to enter any given area of economic activity, then that area of economic activity is free of the usual undesirable effects attributed to monopoly, even if there is only one producer. After all, how long do you think there would be only one producer in a given area of activity if the rate of return on sales and invested capital was 300% a month? The undesirable effects of monopoly, meaning in my view the causing of disadvantageous terms (such as high prices) to consumers who have no easy recourse to alternative sources, are possible only if there is effective prevention of others entering the field. It matter whether there is already only one producer or five producers in the area. The point is the prevention of others from entering it.

We have been talking here about wealth acquired in a free market, not acquired because you have an 'in' with the government which has granted you a monopoly. We are not talking about someone who becomes wealthy because he happens to own a TV station in Austin, Texas, the only TV station in the country affiliated with all 3 major networks because he was a powerful U.S. senator and somehow kept the Federal Communications Commission from issuing licenses for more stations in the area. This kind of shenanigans is indeed a Zero Sum Game and frequently a Negative Sum Game transaction for the country as a whole because there was coercion involved. Others were prevented by force (of law) from establishing stations there.

Employment

Another example of the Positive Sum Game is the realization that employment is another form of trade. While it has commonly been said that employers will pay workers no more than they have to, and this is true, it is certainly at least equally true that employees will work for no less than they can get. Therefore at the balance point where all the available labor is taken everybody is getting the best deal that is available. (The 'best available deal' principle simply means that the Cadillac dealer would like to sell his Cadillacs for $40,000 each and I would like to buy them for $4000 each and there is not going to be any exchange unless and until we reach a point where we both are still willing to transact business.) Thus, there is no fraud and the workers are not automatically exploited by employers. Employers would like to hire everybody for 25 cents an hour and workers would like to make $1,000 an hour. At some point in between they can come to terms.

Now when we come to the statement on page 13 in the above-mentioned textbook, "Profits are made by getting workers to produce more in value than they receive in wages," we can approach it with some understanding. This is a very common and glowing example of the Zero Sum Game fallacy. Why would you or anyone else hire workers if you didn't expect to "gain" more than you gave up. But this is the only reason the worker goes to work, too. He expects "gain" (cash) more than he gives up (time). Why does he give up his time? Because by working and receiving the cash he can accomplish more than he could if he were to use his time to produce all the things he needs and desires by himself. It is to his advantage (he sees it to his advantage) to "produce" what he wants by working for an employer to get the easily tradable cash with which he can get others to do those things which he wants done.

The Answer to the Question

Let us now go back to our original question: As a Judeo-Christian MORAL principle (please note the word moral), should all trades result in equal value being received by both parties? With an understanding of the Positive Sum Game nature of freely entered trades, the obvious answer now is, "No." By THEIR evaluation, not vours, both parties should GAIN value, not receive equal value. The envy fueled by the wrong answer to this one simple question is probably the main impetus to all the leftist ideology in the world. Of course the envy generated by this error is never examined. It is given as a moral ideal that since all trades should be 'fair and equal,' anyone who has more to show for his efforts than his neighbors is somehow dishonest, and therefore any form of leveling is not only fair but almost a moral obligation. With our new understanding we can now realize that he who produces more of value to others will be rewarded more by those others, he also will become wealthier, and he is indeed a benefactor AS JUDGED BY THOSE OTHERS. Some people buy Bibles, some buy what others consider pornography. Some people buy tickets to symphony concerts, others to rock concerts, and the performers' incomes reflect this.

As economist Walter Williams has said, "Voluntary exchange is characterized by a proposition such as: 'I will do something good for you if you will do something good for me.'" People who hold the fallacious Zero Sum Game theory of economics offer, as the cure for the wrongs they perceive, the use of government coercion to achieve a leveling process (e.g., progressive taxation RATES) where the nature of the governmentally forced transaction is, to quote Mr. Williams again, 'If you do not do something good for me, I will do something bad to you"'. More of this we don't need.

In Summary

The most basic concept of economics is probably the subjective theory of value. The second most basic concept is that free-market economics is a Positive Sum Game, in which the parties do not receive equal value, but both receive increases in value. In the absence of force and fraud, the process is MORALLY correct because neither party lost in the exchange—both gave up what they each valued less to get what they each valued more. What more could you ask other than that everyone else be your slave?

Whenever you read a news article or essay on the state of the world or see a TV news program or special, keep this principle in mind and see how frequently this simple concept is violated or its opposite, the erroneous Zero Sum Game is mentioned or assumed.

This 'TRUTH TABLE' shows all the possibilities for whether or not a trade will take place between two persons, Smith and Jones. ND* means 'no difference. The person expects to gain nothing at all from the trade, but he feels he won't lose anything either. While the questionable cases are possible, the person who only expects to come out even will not be enthusiastic and certainly will not be actively searching for such a trade.

To return from PRINT page, click "back" arrow on your browser